Drive product market fit and strategy with this segmentation schema

People are probably not using your product the way you think

Product market fit (PMF) is one of the hardest things to get right and it’s necessary for a startup to survive and thrive. Even scale-ups and established companies face PMF challenges as soon as they start growing into new markets and product categories. There has been a ton of great writing about how to know when you have PMF and structured approaches to measure and influence it (e.g. Super Human’s product market fit engine).

At AMBOSS we recently conducted churn and PMF interviews with many of our German physician users. We realized that it would help us discuss PMF and derive actions from our interviews when applying the segmentation scheme that I want to share with you in this post.

During our interviews, we uncovered two distinct groups of users:

(1) Users who used our product as we expected — as a clinical decision support tool; and

(2) Users who had used our product during their medical studies and for their exams, but had never adopted us as product that could help them in their clinical work.

This was quite a surprise to us! We assumed most of our clinician users would organically pivot to the clinical reference use case once they finished their medical school exams and are confronted with the clinical world. What we assumed about our users was not correct for a smaller, but significant, portion of our user base. Luckily we didn’t fall into this trap:

Here’s another great example of how easy it can be for people to use products in ways we didn’t intend and still get value from them.

Our experience with this prompted us to develop a framework that helped us navigate discussions about how to prioritize feature work vs. growth work vs. product-market fit expansion.

🤫 A word of caution before you dive in:

Frameworks covered in product blog posts are all over the place nowadays. In my experience, copy-pasting these rarely works out. Often the practical takeaway should be treated as inspiration for how to think about things, not necessarily something that you can ask your team to apply right off the shelf.

The same goes for the framework outlined in this article — consider it a suggestion to help structure your thinking, steer discussions, and eventually inform your product discovery.

A segmentation schema

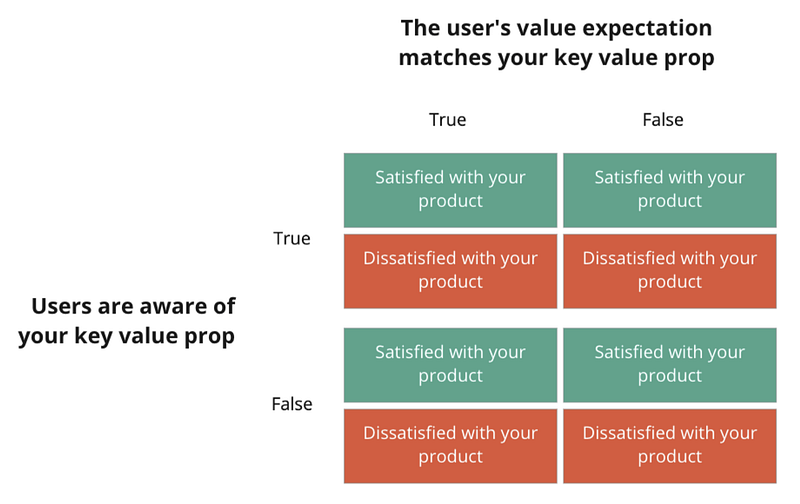

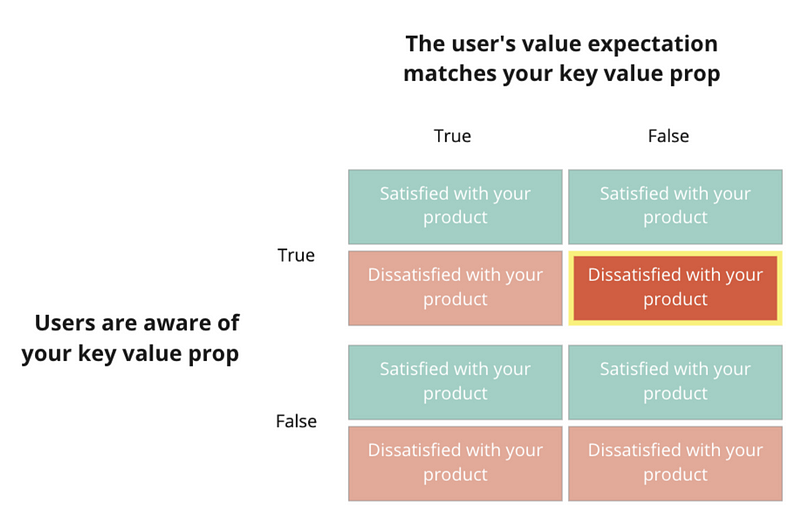

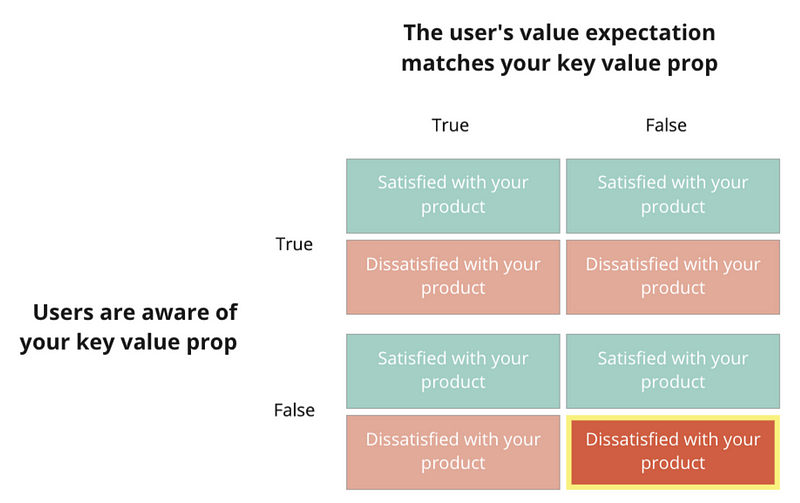

Before we started this project, we primarily segmented our users by use, age, or medical specialty. In our discovery work we realized that what users think AMBOSS does and what AMBOSS can actually do for them sometimes diverges. As a result of this insight, we created a new framework for segmenting our users with 3 dimensions:

- Need: The need your user expects to get addressed from your product matches what your product intends to address (your key value proposition)

- Awareness: Users are aware of your key value prop

- Satisfaction: Users are satisfied with how well your product addresses their key need

If you add these categories into a 2×2 matrix you get something like this:

This segmentation matrix becomes actionable as soon as you understand which and how many users live in each of these categories, and what these categories can tell you about which actions you should prioritize.

Each category implies a set of different strategic options regarding product work (feature work, growth work, product-market fit expansion) or marketing work (strengthening comms, value prop or brand awareness).

The upper row (users are aware of your key value prop) will result in more opportunities for product and the lower row (users are unaware of your key value prop) will result in more opportunities for marketing, brand, and growth.

Below, we’ll go through all of the combinations and I’ll suggest ideas and which potential opportunities they point to.

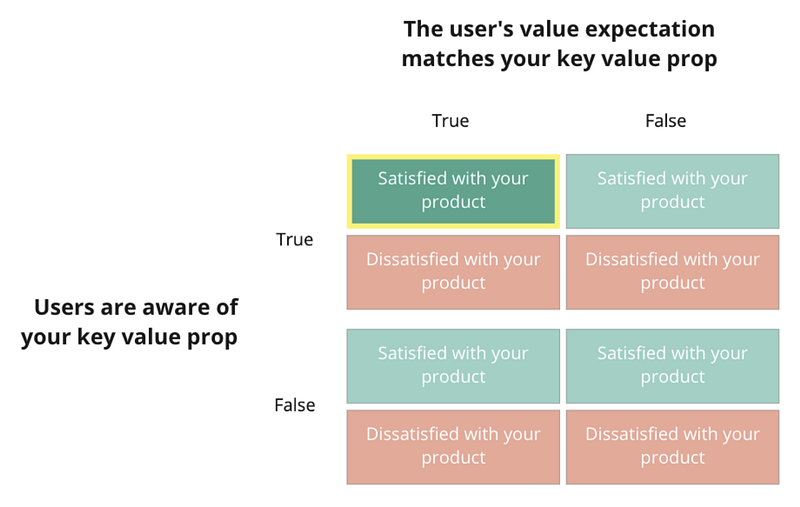

- Summary: Your product’s value prop matches your users’ needs, they are aware that your product’s main focus is to address their needs and they are satisfied with your product. Congrats 🎉 These are your ideal users and it’s likely that you found product market fit for them!

- Questions to ask: You are very lucky if you also found a market that is big enough and undersaturated with solutions like yours. So, how big is this segment? Is it the majority of your users or a minority? Understand what drives these users and how they behave when using your product. Ask them: How would you describe a user who benefits from your product? The answer will draw a picture of your most important persona(s).

- Opportunity: This can act as a north star for either acquiring similar users or model existing users of neighboring groups into this group.

- Example: A lot of Apple product’s like AirPods play in this segment. Apple fans tear these products from their maker’s hands. These users know exactly what the company does, what the product offers and very often they really want Apple’s products and are extremely satisfied with them. Apple bases a large part of their business on their reputation to predictably serve this bucket well.

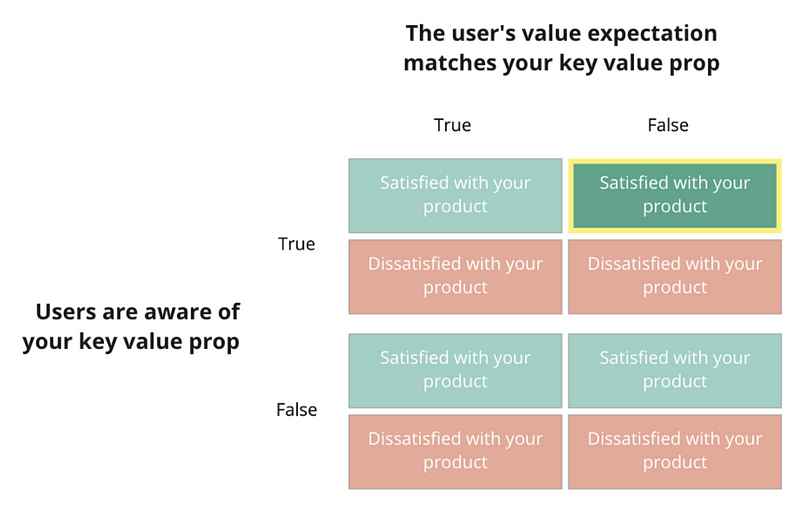

- Summary: These users found something valuable in your product despite knowing it serves a different purpose! What you thought they would value is not actually what they value.

- Questions to ask: What is it that motivated these users to sign up? What did they expect from your product in their first days of using it? How did their usage differ from what you expected, and what was their journey to discovering the new value? How are they using your product and what for?

- Opportunity: This segment, if big or promising, allows you to identify sources of emergent value that can lead to capturing a new segment, or may even show you how to pivot your product.

- Example: Google realized that in larger organizations not everyone can write complex queries to analyze big data sets. So some people successfully use Sheets to do basic analyses. Users found value that neither BigQuery nor Sheets primarily aimed to deliver. Google sensed an opportunity and extended BigQueries and Sheets value to truly serve the “professional data amateurs” segment with Google Connected Sheets in 2020.

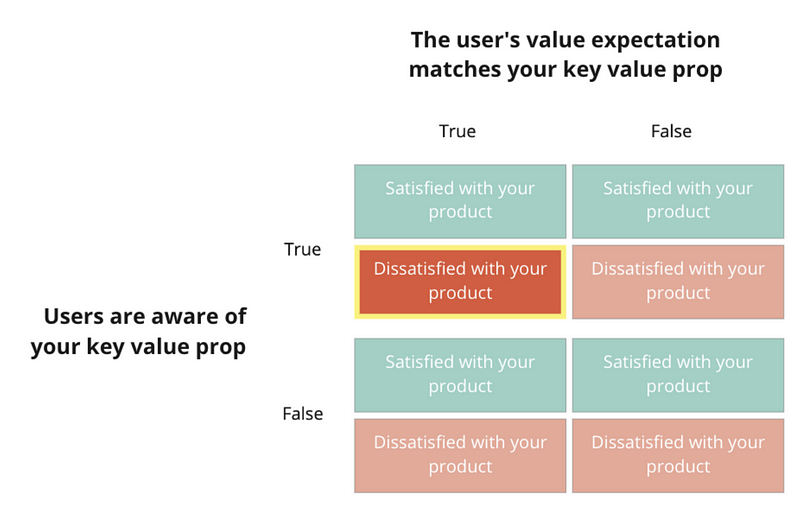

- Summary: Your product addresses what users were looking for and they are aware of that but still not happy! These are users you were targeting, but you let them down.

- Questions to ask: What’s preventing them from getting value out of your product (bugs, lack of functionality, price, etc.)? How could you address their needs better?

- Opportunity: This is Product-Market-Fit work! You might want to try and move these users one level up, from dissatisfied to satisfied.

- Example: AMBOSS’ key value prop for physicians is Actionable and trustworthy answers to most clinical questions in a few seconds. In the early days when we launched our physician product, most users were aware of this value prop but some struggled with our search functionality. They’d simply not find answers quickly enough. We understood this unmet need and set up a product team entirely working on search. They have the long-term objective to reduce the time to the right knowledge. The team performs amazingly well and continuously delivers incremental speed boosters that move users up, from the dissatisfied to the satisfied bucket.

- Summary: These users expected something in your product that they know you don’t offer and they didn’t find anything valuable.

- Questions to ask: What is it that motivated these users to sign up, what did they expect in your product in their first days? Did it cross their mind to use your product for something different? What’s missing for them to get value out of your product?

- Opportunity: This segment may contain people who wanted to take a look at your offering but stopped using your product. You can try lifting these users one level up from dissatisfied to satisfied by understanding and addressing their needs through product work. However it’s important to note that they may have an adjacent problem in the market or need a different solution that you don’t currently offer. It then becomes a business decision if you want to solve this problem or provide this solution. You may not want to do that, so this may be a market segment you don’t choose to pursue.

- Example: Twitter set out to create a network of people exchanging relevant information around certain topics using hashtags. Many journalists joined Twitter expecting to be able to create a living narrative around certain stories. This was often unsatisfying as the information around hashtags is unstructured by design. Twitter recognized the new and unmet need for more structured narratives and released Twitter Threads to satisfy this segment.

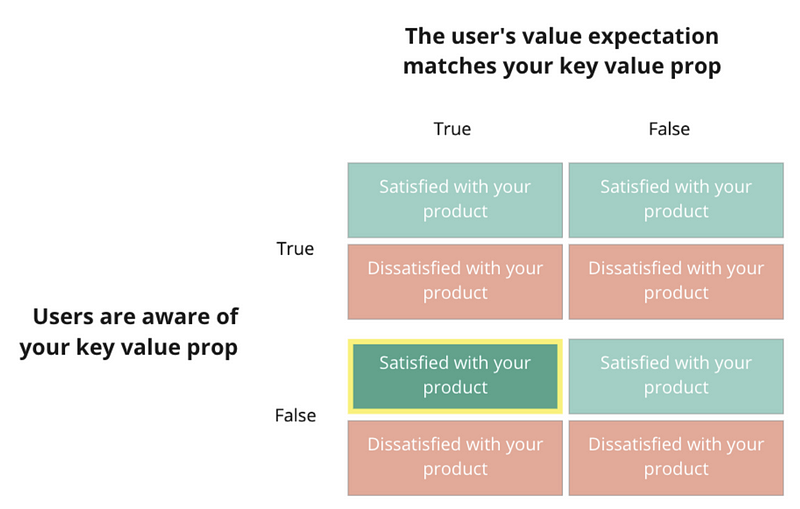

- Summary: Your product’s core value successfully addresses what your users expected from it. However, they are not aware that your product is actually for them — they do not see themselves in your value prop. These are great users and it’s likely that you found product market fit for them but they won’t help you with referrals and may not be as loyal. They may be prone to trying competitors with stronger marketing or brands.

- Questions to ask: These users don’t know or understand your value prop or identify with your product and brand. You would want to find out how they understand your product, and listen for where they looked for the value prop that represents them. You can then guide them to discover your product’s value.

- Opportunity: Learning what they see in your product might help you adjust how your entire product and marketing experience enables your users to understand and utilize the full range of value the product can offer. And you might be able to increase the loyalty of these users to your product by making them aware of the fact that you actually aim to continuously and delightfully meet their needs.

- Example: People discover Notion at work as a workplace tool. A fraction of these users also discover Notion’s value for private use, and use it for journaling. Some of these users don’t know that Notion actually does target private journaling nerds. These users with a primary touch point at work will less strongly advocate for Notion as a journaling tool, unless Notion addresses these workplace-to-private converts directly and makes it clear that journaling is actually a use case Notion actively supports and is built for.

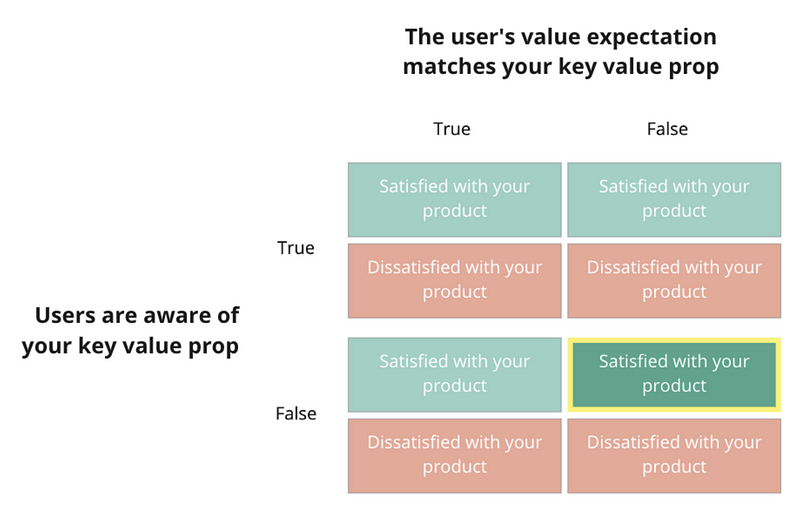

- Summary: These users found something valuable in your product without knowing it actually serves a different purpose! Likely they don’t understand your product positioning, value prop, and marketing but still get value out of it.

- Questions to ask: How would they describe the core value your product offers to a friend or family? Which needs do your product satisfy for them? Why did they sign up in the first place? What did they expect to get and how did this expectation change over time?

- Opportunity: If large enough, this segment represents an opportunity for expanding the communication about your feature-set or services. You could probably adapt your product to truly serve this segment and acquire new users falling in this category.

- Example: Dating platforms like Tinder learned that many people’s needs don’t match the product’s key value prop — a segment of users wanted to find friends, not lovers. Bumble recognized this and added making friends to their key value prop when launching Bumble BBF.

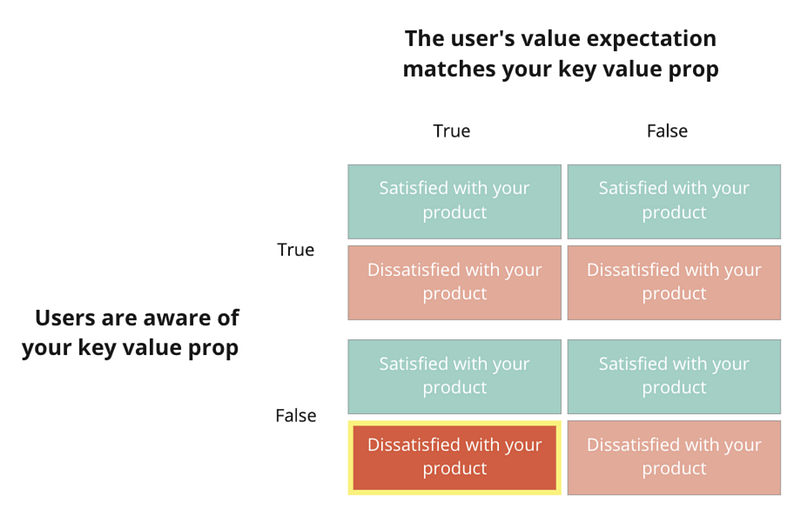

- Summary: Your product poorly addresses what users were looking for but they are not even aware that you aim to do better.

- Questions to ask: What was their expectation before trying your product? How does their first time user experience differ from that of users in the top-left? Why are they dissatisfied and what could you do to increase the value they get out of the product? Why are they not aware of your value prop? Is it a marketing issue or does your UX not communicate the value right?

- Opportunity: If this group is big you might not have product-market-fit yet, but at least you have a market looking for a solution to their problems that’s aware of you! 🥲 Learn about how to adjust your product and your marketing to help these users get to the top left.

- Example: At AMBOSS in the very early start-up days, we used Skype because it was free and easy. However, we hit roadblocks with certain features of Skype (e.g. conferencing) and weren’t sure that they would support us well in the future. We churned and now use Slack and Zoom. Skype actually aims to satisfy the needs of business customers alongside private users. Had they marketed and sold their business user value prop more strongly and improved their product faster and earlier for business users, they might have kept customers like AMBOSS.

- Summary: These users likely came to you, didn’t find value and are not sure what the intended value actually is.

- Questions to ask: Are these just users who make an account to have a look and leave? What activity do these users show? What did they try, what didn’t they try? Can you find out more about their intentions? There must be something that attracted them to your product and that you could double down on. Do you shove people into your product who come with false expectations, spending too much marketing budget on too little focused marketing?

- Opportunity: This is the hardest segment, as it likely has many users who make an account, try your product but really don’t find or get your product’s value. If this segment is large it could be positive or negative. It’s negative if it’s due to mushy messaging and falsely set expectations during user acquisition. It’s positive if you did all this right, and can actually move people from dissatisfied to satisfied by improving the product to serve their distinct need.

- Example: A prominent example of this is Google Wave. Wave was a mix of email, chat, wiki, blog and photo app. However, the value prop was broad and mushy, the user interface was complex, the community was gated, and apart from a strong fan base many users left unsatisfied without really knowing what to make out of Wave. Wave’s end was announced in 2010. In the following years Google successfully unbundled some of Wave’s value into single GSuite products. This helped them keep the value props separate, understandable, and maintainable while still offering the “one-stop-shop” use case via integrations between all single apps.

Clarity and direction from segmentation concepts

As product people, we’re often challenged to generate clarity, direction, and define a strategy from unstructured and ambiguous inputs. A first step to getting towards more clarify could be to measure your user base’s perception of your product by the 3 dimensions outlined in this post: Need, Awareness and Satisfaction.

As a second step, you can use this framework to identify and visualize your company’s unique product-market fit pattern. This will help you better understand which kind of product work to prioritize and how to adapt your marketing campaigns and positioning.

I hope that you enjoyed this article! If you have any thoughts, questions, or suggestions leave a comment below or reach out to me on LinkedIn.

A big thanks goes to my colleagues Julia Nelson and Maithili Pai for critically reviewing the article and contributing with many great suggestions and ideas. ❤️